Steps to Integrate Secure Payment Gateways in Mobile Apps

Mobile applications have become a primary channel for commerce, subscriptions, and on-demand services. Users expect fast, seamless, and safe payment experiences, and any failure in payment security can quickly erode trust and damage a brand’s reputation. This makes integrating secure payment gateways a critical priority for businesses building or scaling mobile apps. Beyond enabling transactions, payment gateways serve as a safeguard against fraud, data breaches, and regulatory non-compliance. This article provides a comprehensive, step-by-step guide to help businesses and developers understand how to successfully implement secure payment solutions while maintaining user confidence and operational efficiency.

Securing Payment Gateways

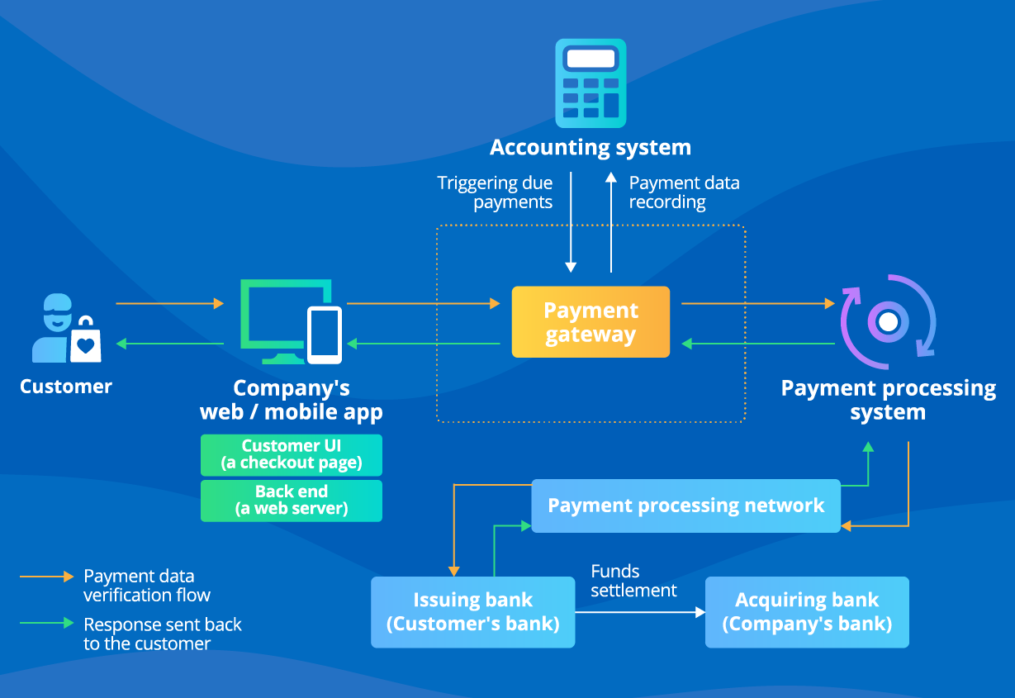

Before diving into implementation, it is essential to understand what payment gateways do and why integrating secure payment gateways is more than a technical checkbox. A payment gateway acts as a bridge between a mobile app, the customer’s bank, and the merchant’s acquiring bank, securely transmitting sensitive payment information. Modern gateways also provide encryption, tokenization, fraud detection, and compliance support. Choosing the right gateway ensures that transactions are processed accurately while protecting user data from unauthorized access or cyber threats.

Step 1: Define Business and User Requirements

The first practical step in integrating secure payment gateways is clearly defining your business and user requirements. This includes identifying supported payment methods such as debit cards, credit cards, mobile wallets, bank transfers, or regional payment options. You should also assess transaction volumes, currencies, geographic coverage, and user demographics. From a user perspective, simplicity and speed are vital, while the business must consider fees, settlement timelines, and scalability. Aligning these needs early prevents costly changes later in the development cycle.

Step 2: Choose a PCI-DSS Compliant Payment Gateway

Security compliance is non-negotiable when integrating secure payment gateways into mobile applications. Payment Card Industry Data Security Standard (PCI-DSS) compliance ensures that the gateway follows strict guidelines for handling cardholder data. Reputable gateways invest heavily in infrastructure, audits, and certifications to maintain compliance. By selecting a PCI-DSS compliant provider, businesses reduce their own compliance burden while ensuring that sensitive financial data is managed according to global best practices.

Step 3: Select the Right Integration Method

Payment gateways typically offer multiple integration options, such as hosted payment pages, in-app SDKs, or API-based custom integrations. The method you choose plays a significant role in integrating secure payment gateways efficiently. Hosted solutions are faster to deploy and shift much of the security responsibility to the provider, while SDKs and APIs allow greater customization and branding control. Businesses should balance development complexity, user experience, and security responsibility when selecting an integration approach.

Step 4: Implement Strong Data Encryption and Tokenization

A core element of integrating secure payment gateways is protecting sensitive data during transmission and storage. Encryption ensures that payment details are unreadable if intercepted, while tokenization replaces sensitive card data with non-sensitive tokens. These tokens can be safely stored and reused for recurring payments without exposing actual card information. Implementing these measures significantly reduces the risk of data breaches and reassures users that their financial details are protected.

Step 5: Enable Multi-Factor Authentication and Secure Authorization

User authentication is another critical layer in integrating secure payment gateways effectively. Features such as one-time passwords (OTP), biometric verification, and 3D Secure authentication add extra protection against unauthorized transactions. While security is paramount, it must be balanced with usability to avoid friction that could lead to abandoned transactions. A well-designed authentication flow enhances trust without compromising the user experience.

Step 6: Integrate Fraud Detection and Monitoring Tools

Fraud prevention is an ongoing process, not a one-time setup, and it is central to integrating secure payment gateways successfully. Many gateways offer built-in fraud detection tools that analyze transaction patterns, device fingerprints, and behavioral data in real time. These tools help identify suspicious activities before they result in losses. Continuous monitoring and rule optimization ensure that the payment system adapts to emerging threats and evolving fraud tactics.

Step 7: Test Transactions in a Secure Sandbox Environment

Thorough testing is essential before launching any payment feature, and it is a crucial phase in integrating secure payment gateways. Most providers offer sandbox environments that simulate real transactions without moving actual funds. Developers should test successful payments, failed transactions, refunds, chargebacks, and edge cases. Rigorous testing helps identify bugs, security gaps, and user experience issues early, reducing the risk of costly failures after launch.

Step 8: Ensure Regulatory and Regional Compliance

Beyond PCI-DSS, businesses must consider regional regulations when integrating secure payment gateways. Data protection laws, financial regulations, and consumer protection requirements vary by country and region. For example, compliance with local data residency rules or central bank guidelines may be mandatory. Understanding and adhering to these regulations not only avoids legal penalties but also builds credibility with users and partners.

Step 9: Optimize User Experience Without Compromising Security

A common misconception is that security always adds friction, but effective integrating secure payment gateways can enhance user experience. Clear payment flows, minimal data entry, saved payment methods, and transparent error messages all contribute to smoother transactions. Security features should operate seamlessly in the background, providing protection without overwhelming users. The goal is to make secure payments feel effortless and intuitive.

Step 10: Leverage AI for Smarter Payment Security

As technology evolves, artificial intelligence is playing an increasing role in integrating secure payment gateways. AI-powered systems can analyze vast amounts of transaction data to detect anomalies, predict fraud patterns, and reduce false positives. An important question for modern businesses is: how can AI-driven payment security improve trust while maintaining frictionless user experiences? By leveraging AI, payment systems become more adaptive, proactive, and resilient against sophisticated threats.

Conclusion

Successfully integrating secure payment gateways in mobile apps requires a strategic blend of security, compliance, and user-centric design. From selecting a compliant provider and implementing encryption to leveraging AI-driven fraud detection, each step plays a vital role in building a reliable payment ecosystem. A secure and seamless payment experience not only protects businesses from financial and reputational risks but also strengthens user trust and long-term loyalty. For organizations looking to implement or upgrade secure payment solutions in their mobile applications, clients should reach out to Techvantage Innovations for expert guidance, robust development, and end-to-end support tailored to modern digital commerce needs.