HOW PAYMENT GATEWAYS MAKE GLOBAL PAYMENT PROCESSING EASY

Global processing is done by most businesses today using payment gateways to make international transactions simple and customer-convenient. Online platforms enable secure payments between merchants and customers, handling various currencies for global business success. This article explains how payment gateways work, their relevance, and how innovations like AI are revolutionizing cross-border payments.

THE CORE FUNCTION OF PAYMENT GATEWAYS FOR GLOBAL PROCESSING

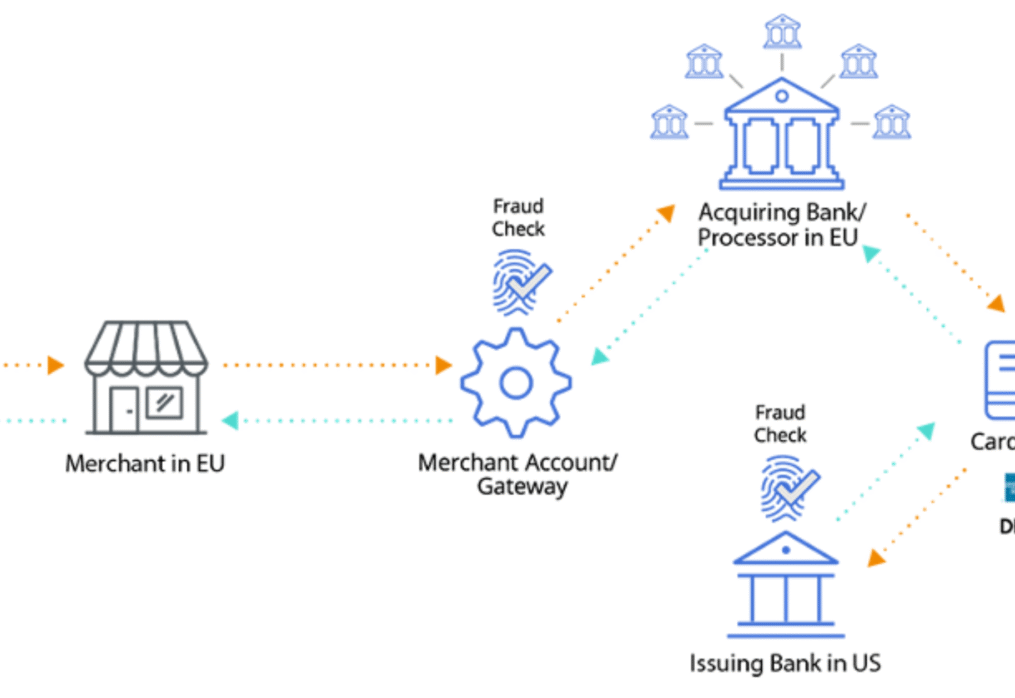

Fundamentally, international payment gateways are bridges that connect online merchants and banks. When a customer places an order, the payment gateway encrypts confidential data such as credit card details and sends them securely to the acquiring bank for authorization. The whole process takes place within seconds, and this makes it possible for merchants to authorize transactions instantly.

For global companies, payment gateways are essential for combining diverse payment infrastructures. They make seamless interaction among banks, e-wallets, and alternative payment systems on various continents possible. Without global payment gateways for processing, issues of currency compatibility, delayed settlements, and security risks would mar international trade.

ENABLING CURRENCY CONVERSION AND MULTI-CHANNEL PAYMENTS

Global payment gateways support multiple currencies and payment types, automatically converting amounts like U.S. dollars, British pounds, or Nigerian naira at current exchange rates. This eliminates confusion for both buyer and seller while promoting price transparency.

Besides, global payment gateways support various modes of payment, credit cards, debit cards, PayPal, Apple Pay, Google Pay, and even new electronic wallets. By supporting multiple payments, businesses are able to cater to a larger base of customers and drive conversion rates. Multi-channel acceptance boosts customer confidence by allowing payments through preferred local methods without extra fees.

SECURITY AND COMPLIANCE IN INTERNATIONAL TRANSACTIONS

Security is the backbone of payment gateways for global processing. Cyber attacks necessitate robust mechanisms featuring encryption, tokenization, and fraud protection, while gateways must comply with stringent global standards like PCI DSS to protect cardholder data.

Additionally, cross-border payment gateways deal with domestic financial regulations, tax compliance, and anti-money-laundering (AML) laws. This removes the burden from businesses to navigate several regulatory environments with transparency and accountability. For customers, it provides a feeling of security that their payment details are safe in all transactions.

INTEGRATION AND SCALABILITY FOR INTERNATIONAL BUSINESSES

Scalability is yet another important benefit of payment gateways to global processing. Furthermore, as companies venture into new markets, they require a payment system that responds to varied market conditions. In addition, these gateways work nicely with e-commerce systems, CRM packages, and accounting tools, thereby enabling it to be simple to monitor sales and monetary performance geographically.

Thanks to APIs and plug-and-play modules, developers can integrate global payment processing gateways within websites or applications without significant coding. Flexibility allows startups to quickly access international markets, providing seamless checkout experiences for global users. Scalable payment infrastructure provides a guarantee that as the number of transactions grows, security and performance are always maximized.

ARTIFICIAL INTELLIGENCE AND THE FUTURE OF GLOBAL PAYMENT GATEWAYS

AI is changing the dynamics of how payment gateways for overseas processing operate. Companies are using machine learning algorithms more and more to identify attempts at fraud based on real-time examination of transaction histories as well as behavior of users. Predictive analytics help identify likely chargebacks prior to their occurrence, thus saving companies from losses.

Moreover, AI personalizes by tailoring payment experiences to geography and user preference. For example, smart gateways can be coded to display the most suitable payment methods dynamically, based on location and previous buying behavior. This AI-driven optimization not only fuels better conversion but also loyalty.

An interesting question of the digital era is: How can we design payment gateways to be independent and safe enough to automate global processing without any human involvement?

The intersection of financial technology and artificial intelligence continues to redefine the way payments are processed globally and monitored.

Customer experience is essential to international business, and international processing payment gateways directly influence how consumers perceive a brand. A fast, secure, and straightforward checkout can be the difference between whether a consumer buys or abandons the cart. Multi-language-supported gateways, presentation of regional currencies, and instant transaction affirmation boost satisfaction and encourage repeat visits.

Additionally, cross-border payment gateways reduce friction in subscription billing, recurring payments, and refunds. They are capabilities that are vital for online memberships, SaaS products, and digital goods. Customers adore ease of use, and gateways that streamline cross-border payments establish long-term loyalty.

TAKING THE EDGE IN CROSS-BORDER PAYMENTS

While they are useful, international processing payment gateways come with their own set of problems, such as fluctuating exchange rates, transaction fees, and geographic restrictions. To address these concerns, modern gateways employ smart routing, automatically choosing the lowest-cost route to process a transaction. Furthermore, they also interact with multiple banks and processors so that latency is minimized and uptime is always available.

Consequently, businesses must choose payment gateways for global processing that offer transparent pricing, 24/7 support, and reliable performance. Moreover, evaluating features like settlement times, chargeback management, and integration options helps organizations pick the right partner for their international payment needs.

CONCLUSION: PARTNER WITH TECHVANTAGE INNOVATIONS FOR SEAMLESS GLOBAL PAYMENTS

In the era of instant international commerce, speed, security, and connectivity as the drivers of trade, global payment gateways are now a key tool to achieve success. They enable businesses to grow across borders, settle in multiple currencies, and deliver world-class customer experiences. Advancing technology, AI analytics, and automation make the future of international payments efficient and intelligent.

For businesses seeking to implement or expand payment gateways for global processing, expert guidance is necessary. Techvantage Innovations is a specialist in digital integration, e-commerce optimization, and global payment processing solutions that help businesses expand smoothly across markets.

Contact Techvantage Innovations today, and let’s build the bridge between your business and the world.