How to Create a Money Lending App: Features & Development Guide

With the new digital economy, transactions in money have gone mobile. Many have started making money lending happen through digital platforms as a result of convenience, security, and speed. Having a money lending app allows businesses and business owners to leverage this growing market while providing value to customers. This essay addresses the features, process, and methodologies necessary to develop a successful lending app.

Understanding the Money Lending App Concept

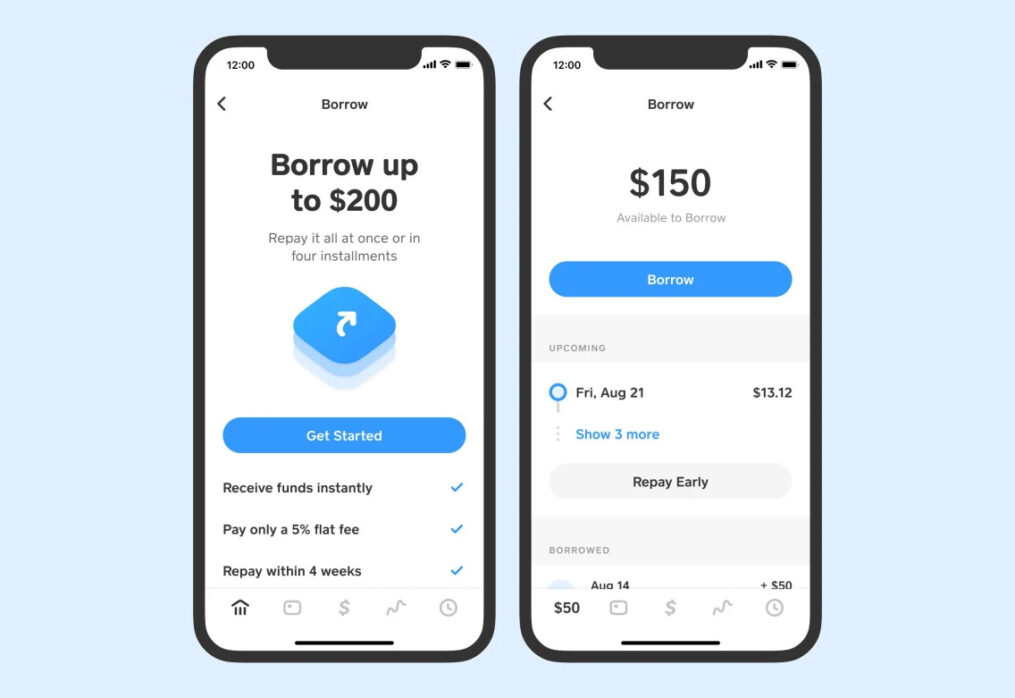

A money lending app is a web-based application that provides the interface between lenders and borrowers, enabling users to take quick loans with less effort in visiting a bank. The apps automate the process of loan approval, mechanize paperwork, and offer secure repayment avenues. Whichever the peer-to-peer or institutional loan supply may be, a lending app bridges the gap between financial institutions and end-users by use of technology.

Why Businesses Should Invest in a Money Lending App

Investment in a money lending application has long-term advantages for startups, financial institutions, and fintech entrepreneurs. The lending company globally is likely to grow with exponential growth as digital-first financial services become increasingly acceptable. Businesses can grow at a higher rate, reduce operational expenditures, and increase the customer base with the creation of a money lending app. Additionally, automated aspects embedded in the lending app minimize human mistakes and enable fast loan approval.

Core Features That Every Money Lending App Must Incorporate

While creating a competing money lending app, it must incorporate core features that enhance functionality, security, and user experience.

User Registration & Verification – Reassuring sign-up with KYC (Know Your Customer) and identity verification software.

Loan Application Form – Simple and transparent interface through which borrowers are able to submit loan applications.

Credit Score Analysis – Integration with credit rating companies to check borrower eligibility.

Instant Approval for Loans – Auto-eligibility and quick approval processes.

Channels for Repayment – Multiple modes such as bank transfer, debit cards, or mobile wallets.

Notification & Alerts – Real-time updates on loan status, repayment dates, and repayments.

Protection of Data – End-to-end encryption and compliance with financial regulations for safekeeping of sensitive data.

AI-Powered Assistance – AI-based chatbots and predictive analytics for enhanced customer engagement.

An app with money lending features described above not only charms customers but also creates long-term trust and reliability.

Step-by-Step Guide to Developing a Money Lending App

Developing a money lending app requires careful planning and execution. The following is a step-by-step guide:

Market Research & Target Audience

Identify the need for online lending, measure competition, and determine your niche. A successful lending app must cater to special financial requirements.

Compliance & Licensing

Since a lending app is founded on financial transactions, it is necessary to adhere to government regulations and obtain proper licenses. This establishes credibility and user trust.

Choosing the Right Tech Stack

Developing a lending app calls for technologies like React Native or Flutter for cross-platform apps, secure backend technologies, and APIs for payment and credit checks.

Planning the User Interface

The user interface of the lending app should be simple, intuitive, and mobile-optimized. A simple design brings users back to transact.

Security Integration

The lending app has sensitive information, and hence encryption, two-factor authentication, and fraud detection engines are mandatory.

Development & Testing

With the framework set up, the developers begin constructing the lending app and testing for bugs, performance, and compliance problems.

Launch & Continuous Improvement

After the app is launched, user feedback needs to be considered in order to enhance and expand the money lending app for increased performance and usability.

Benefits of Utilizing AI in a Money Lending App

Artificial Intelligence (AI) has revolutionized fintech, and the role of AI in a lending app cannot be overstated. AI enhances credit scoring by means of an analysis of non-traditional data such as customer spending and social behavior, and makes loan decisions more fair and efficient. AI chatbots in a lending app provide 24/7 customer service, reducing support costs. Predictive analytics also helps lenders minimize risks by forecasting borrower behavior.

AI question: Can a lending app fueled by AI ever do away with traditional banks in the management of loans and customer care?

Obstacles to Creating a Money Lending App

Despite the vastness of the scope, developing a lending app is also not an easy task. Compliance with financial regulations varies from place to place, and thus regulation is a major issue. Security of data is yet another serious challenge since breach can damage trust. Developing a credible lending app also means heavy investment in technology and infrastructure initially.

Future Trends in Money Lending Apps

The future of money lending apps looks promising with innovations such as blockchain integration for secure payments, AI-powered loan approval, and biometric security features. As financial inclusion expands, there will be more people who will rely on a money lending app to meet short-term emergency financial needs. The growth provides a good business opportunity for firms to adopt early.

Conclusion

Creating a money lending app requires technology, regulation, and user-centric design. From basic features like loan applications and repayments to advanced innovations like AI-driven credit scoring, a lending app has the power to democratize access to financial services for millions. Businesses looking to enter this quickly growing fintech space require expert advice and trusted development partners.

If you’re ready to build a secure, scalable, and profitable money lending app, reach out to Techvantage Innovations today. Our team specializes in custom fintech solutions tailored to your business needs.